It’s even more of a chore if you’re a small business owner or a multicar family and have to do it for several vehicles.

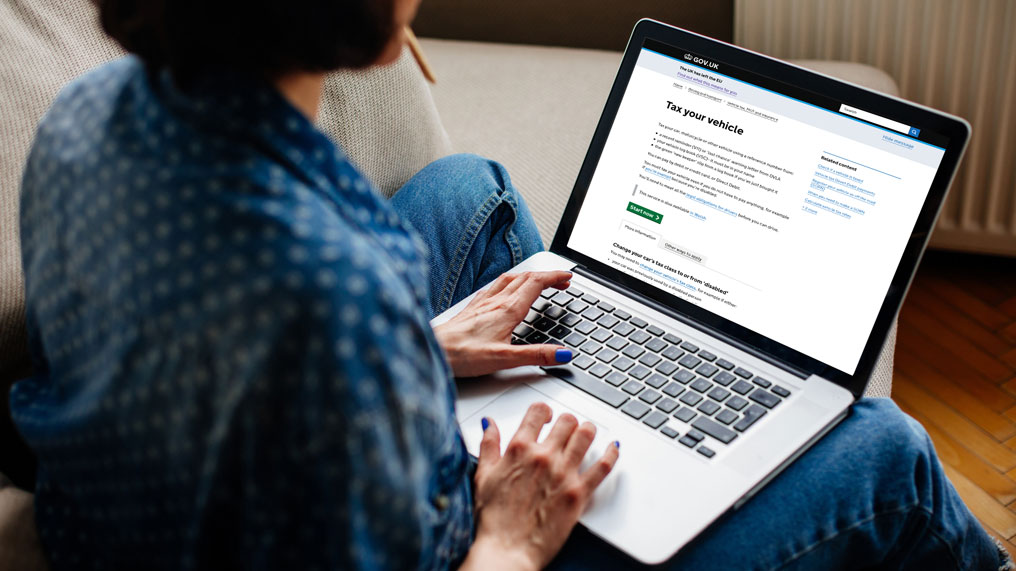

Today, the job can be accomplished quickly and easily by doing it online.

You can renew your tax disc or Statutory Off Road Notice (SORN) on the DVLA’s Vehicle Licensing website.

It only takes a few minutes and can be done 24 hours a day.

Why it makes sense to renew online

When you apply online there’s no need to have any insurance or MOT documents to hand, as the checks are done automatically.

Your car insurance details are run through the Motor Insurance Database, while your MOT is validated against records of MOT test results

Sorting out your car tax online takes minutes and you never have to leave the sofa.

How do you do it?

Go to the DLVA website https://www.gov.uk/vehicle-tax and click on the green ‘Start now’ button.

Fill in one of the following:

-

16 digit reference number from your V11 reminder

-

11 digit reference number on your log book (V5C)

-

12 digit reference number on your New Keeper Supplement (V5C/2) if you've just bought the vehicle

Verify your vehicle details, choose how you want to pay (monthly, every six months or every 12 months) and enter your payment card details. Double check your details, then enter your payment details. You’ll then get a reference number and that’s it.

No more tax discs

Since October 2014, you no longer need to display a disc on your windscreen, so don’t sit by the letterbox waiting for one. They’re now extinct.

Today, road tax dodgers are caught by automatic number plate recognition (ANPR) cameras, which track all cars, and trigger fines of up to £1,000 for drivers who don’t have it.

And don’t worry about forgetting to renew your tax because there’s no disc - the DVLA will still issue a reminder when your renewal is due.

Note: In Northern Ireland, drivers still have to display their MOT discs, but not their tax discs.

How to pay

In a move that’s going to make home finances easier to manage for many, you can now pay for your vehicle tax monthly via direct debit. (Not an option for first registration vehicles, fleet schemes or HGVs).

If you choose direct debit, payments will continue automatically for as long as you hold a valid MOT, or until you cancel the direct debit or inform the DVLA that you no longer have the car.

However, be aware there is a 5% charge for paying monthly or six-monthly.

Is there anything else to be aware of?

Yes, when it comes to selling your car, you can no longer transfer the tax with your vehicle. Instead, your existing tax will be cancelled automatically when you tell the DVLA that you have sold the vehicle. It’s then the new owner’s responsibility to arrange new tax and you’ll receive an automatic refund for any remaining months.

Bear in mind refunds are only given for full calendar months remaining.

The same process applies if you declare your vehicle off road or notify the DVLA that it has been exported.

What if my car’s no longer on the road?

You’ll need to make a Statutory Off Road Notification (SORN) if:

-

You’re not using your vehicle

-

Not keeping it on a public road

-

Not wanting to pay road tax - for example if you’re storing a classic car for the winter

You can arrange SORN online, by calling 0300 123 4321 or at a post office. You can submit the application up to two months in advance.

What about classic cars and other tax-exempt vehicles?

If your car is exempt from vehicle excise duty you don’t have to pay anything, but still need to register each year on the DVLA website.

Am I still able to drive abroad?

While most European countries require some form of tax disc or sticker on the windscreen the British government has told the European authorities have been told about UK’s tax disc changes.

Can I check if a vehicle is taxed correctly?

You can look up the tax status of any vehicle by using DVLA's Vehicle Enquiry System.