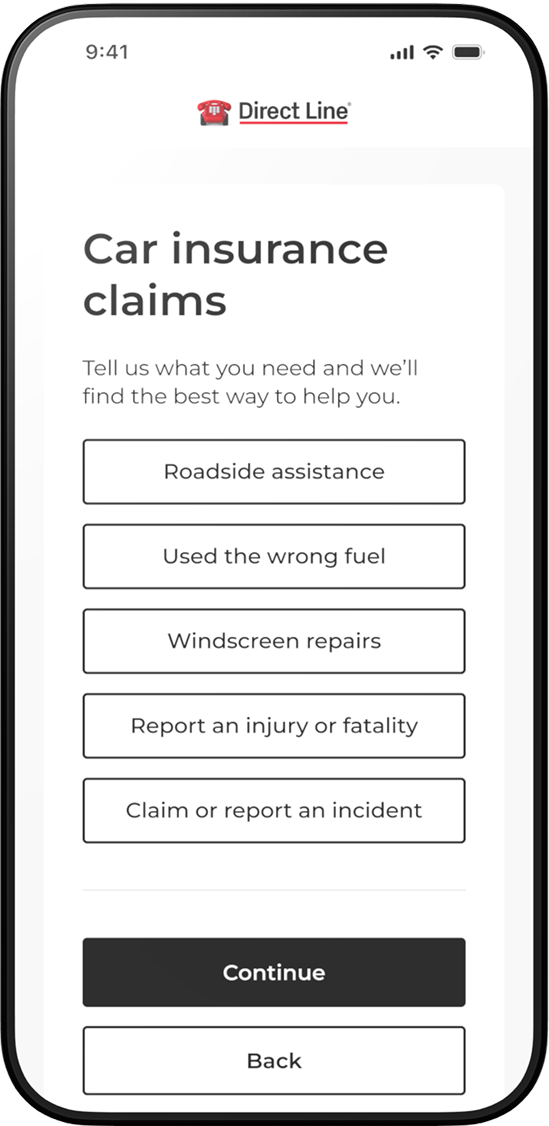

Make a claim online. It can be quicker than calling

Claim or report an incident. We'll confirm your claim straightaway and support you throughout.

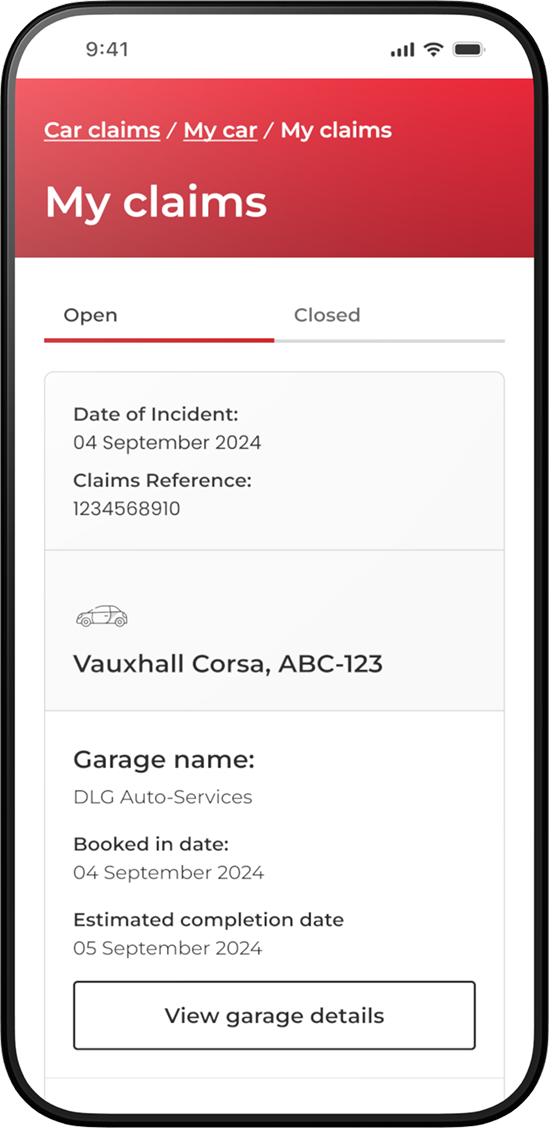

Manage your existing claims

View claims details and documents, check for repair updates, and add details to claims.

Glass damage? Get it repaired or replaced

Book an appointment for windscreen, sunroof or windows in just five minutes through our glass repair partners. Simply:

- Explain the damage

- Provide details

- Select a location for the work

If your cover includes windscreen, sunroof or window damage, you'll only pay the excess.

Book a glass appointmentOur Claims Process

You can make a new car claim at any time. It’s straightforward and can be quicker than calling us. Once done, you can get updates, add additional details and download documents relating to your claims

Make a claimStarted a claim but had to pause it?

You can simply pick up from where you left off by signing into the Car Claims Hub in your account.

Did this help you?

You can access existing claims and related repair information and updates, and add additional details to your open claims at any time. You can also look up and view any closed claims.

View an existing claimDid this help you?

The fault of an accident isn’t always clear, sometimes there are a number of different opinions on what happened. We'll consider your description of the accident and also look at all other information available. Our team of specialists will liaise with third parties and other insurers on your behalf.

Make a claimDid this help you?

This depends on the nature of your claim and whether your no claim discount is protected. If possible, your claim handler will give you an estimate of the impact when you report your claim.

Make a claimDid this help you?

Once we know that everyone is safe and well, the most important thing is to get your car repaired as quickly as possible.

If you use our recommended repairer network, we'll allocate you a repairer straightaway and you won't need to get an estimate. The repairer will call you on the next working day and arrange collection of your car.

The repairer will fully assess the car's damage and contact us with an estimated cost of the repairs. Once authorised, repair work will begin. All work is carried out in accordance with recognised industry standards and each repair is guaranteed for five years unless you sell the car or the lease ends.

After any repairs have been completed by an approved repairer

Once work on your car is finished, the approved repairer will let you know. If there’s an excess applied on your car insurance, you'll need to pay that directly to the approved repairer. In the unlikely event that you are unhappy with your repairs you should raise this with the approved repairer. If you're still dissatisfied after speaking to them, please contact us.

Make a claimDid this help you?

Your car being an “economic write off” means that it’s been considered to be too expensive to repair, so we’ll offer you the market value amount so you can replace it.

This is known as a “settlement value”. You can accept this amount and we’ll gve you the money to buy the replacement yourself.

If your policy includes 'New car replacement' cover and you're the first and only registered owner and your car is less than one year old (Comprehensive cover) or less than two years old (Comprehensive Plus cover), we’ll replace it with one of the same make and model, subject to availability.

This is available if your car is stolen and not recovered, or is written off.

If we can’t find an exact match for your car, your claim will be settled based on the market value of your car at the date of loss.

Replacement cars usually come with a 12-month warranty and free delivery (terms and conditions and exclusions apply). There are some postcodes and islands where we’re unable to provide free delivery.

Please refer to your policy booklet for full details.

Did this help you?

We employ a specialist team to establish the market value of your car. The valuation is what you would expect to pay if you were to buy the car from a used car dealership.

These are some of the factors we use to determine a car's value:

- Overall mileage, age and condition.

- Full-service history.

- Optional extras and modifications.

- Pre-accident condition.

- The local marketplace

Did this help you?

Hire cars

If you have Comprehensive cover, it will include Guaranteed Hire Car, or you can add Guaranteed Hire Car Plus. If you have Comprehensive Plus cover, it will include Guaranteed Hire Car Plus as standard.

Both levels of cover will provide you with a hire car if your car is damaged in an incident, written off or stolen. This excludes windscreen claims.

If your car is repaired by one of our approved repairers, you’ll have the hire car until yours is repaired.

If your car isn’t repaired by one of our approved repairers, or is stolen or written off, we’ll provide you with a hire car for up to 21 days in a row.

Your claims advisor will be able to contact the hire car company for you.

Courtesy cars

Available through our Essentials cover, a courtesy car is provided at no extra cost while yours is being fixed by one of our approved repairers only (excluding windscreen damage), subject to availability.

You will not be entitled to a courtesy car if your car isn't being repaired by one of our approved repairers, or it has been stolen or written off.

If you purchase Essentials cover you have the option to add Guaranteed Hire Car Plus, which will replace the Courtesy Car cover.

Returning a hire car or courtesy car

If you are entitled to a hire car or courtesy car, the provider of the vehicle will agree a return date with you.

You can find more information in your policy booklet.

Did this help you?

If somebody has been hurt in an accident, the first priority is to ensure that they're OK. Claims involving injury can be quite complex so one of our specialist teams may be involved to support you through the process. We handle thousands of injury claims each year and strive to deal with them all fairly and promptly.

Make a claimDid this help you?

When you've agreed a valuation with the engineer, they'll notfiy us, and we'll arrange for a payment to be made. Payments are usually made by bank transfer and once requested, take around five working days to be processed.

Any agreed settlement will be subject to your agreed policy excess, and/or premium adjustment where applicable.

Did this help you?

How does it work?

If you take out Motor Legal Cover with your car insurance policy, we’ll pay up to £100,000 in legal costs for you to take legal action or defend yourself in court. We’ll cover you if:

- you have an accident involving your car that is not your fault and you need help to recover your uninsured losses from the person to blame,

- you’re prosecuted for a motoring offence while using your car and you need help to defend yourself in a criminal court,

- you’re involved in a breach of contract dispute about the purchase or sale of your car, or goods or services you have paid for in relation to your car,

- as long as there is a higher than 50% chance of you succeeding with your claim.

How you need to claim will depend on what has happened

If you’re in a motor accident, you’ll need to tell our motor claims department about any losses you have. This could be an injury or out of pocket expenses that are not covered by your insurance policy.

If you receive notice of a prosecution for a motoring offence, or if you’re in a motor contract dispute, contact the 24-hour legal helpline on 0345 877 6371 for confidential legal advice on any private motoring legal problem. If you wish to make a claim after receiving legal advice, they will start this process for you.

What happens next?

If your circumstances mean that legal cover may be available, your claim will be passed to our specialist legal expenses claims department to review.

If you have a valid claim, we’ll confirm that your policy will cover legal costs charged by a legal representative like a solicitor, as long as you follow their advice and there is more than a 50% chance your claim will succeed. A solicitor will then be instructed to act on your behalf to represent you in your legal claim.

Paying your legal costs

We’ll cover your legal costs of this claim in accordance with the policy terms and conditions. You can read these in more detail in your policy booklet.

Most cases are resolved through negotiation, but a minority go to court. How quickly the claim is concluded will depend on the circumstances, whether your opponent side accepts responsibility (where relevant) and any timetable set down by the court.

Did this help you?

We take insurance fraud very seriously. It drives up the cost of everyone's premiums and we don't think it's fair that the actions of a few should affect so many. Therefore, we're using special detection processes to identify false and exaggerated claims to help keep the cost of your policy down.

Did this help you?

Did you know that it can be quicker to make a claim online than over the phone?

Make a claimIf you still need additional support:

Use our Virtual Assistant 24/7

Did this help you?

Latest articles

What to do if you have an accident

In the moments after a crash, it can be difficult to know what actions to take and what information to collect. Check out this step-by-step guide on what you need to do if you have a car accident.

What to do when your car breaks down on the motorway

With cars travelling at high speeds, breaking down on a motorway is a dangerous situation to be in. That's why it's really important you follow advice designed to keep you and your passengers safe.

Repairing or replacing your windscreen

If you have a chipped screen, you need to get it repaired quickly before it develops into a crack. Here's how to avoid having to replace your windscreen.